Exploring the Benefits of Selling on Depop

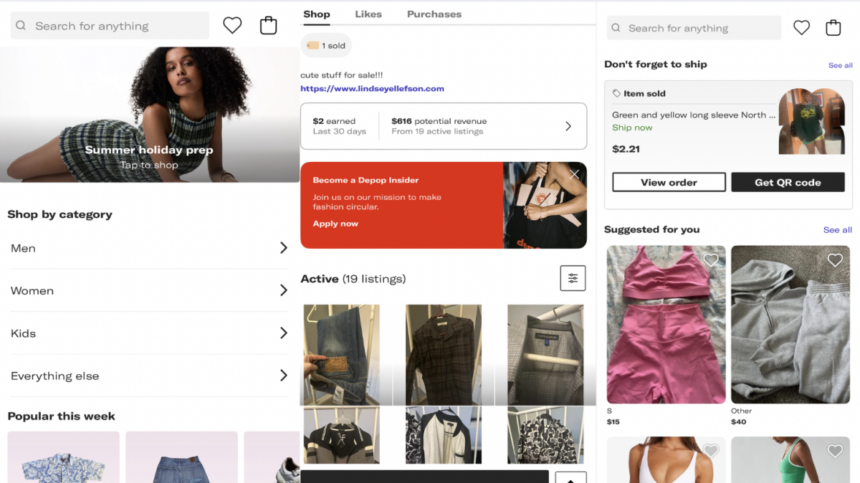

For those venturing into the realm of online selling, Depop stands out as a user-friendly platform, particularly for fashion enthusiasts. The simplicity of both purchasing and listing items makes it an appealing choice. Not only is it a fantastic destination for budget-conscious shoppers seeking unique apparel, but it also presents a lucrative opportunity for sellers.

One of the most attractive aspects of Depop is its lower commission structure compared to many other e-commerce sites. This allows sellers to list their items at competitive prices while still retaining a significant portion of the sale. Even at reduced prices, profits can accumulate quickly, making it an efficient avenue for turning unwanted clothing into cash.